San Carlos Real Estate: The 2023 Mid-Year Recap.

July 7, 2023

A Market in Recovery.

We are officially past the half-way point of 2023, and no matter what metric you study in order to gauge the health of the San Carlos real estate market, they're all down significantly from 2022 as you'll see in the charts below. That should come as no surprise to anyone who reads this blog on a regular basis, because I've been talking for months about all of the challenges facing the current real estate market — higher interest rates, economic uncertainty, and now an insurance crisis. There is no shortage of headwinds working against the market right now.

But that doesn't mean everything is gloom and doom.

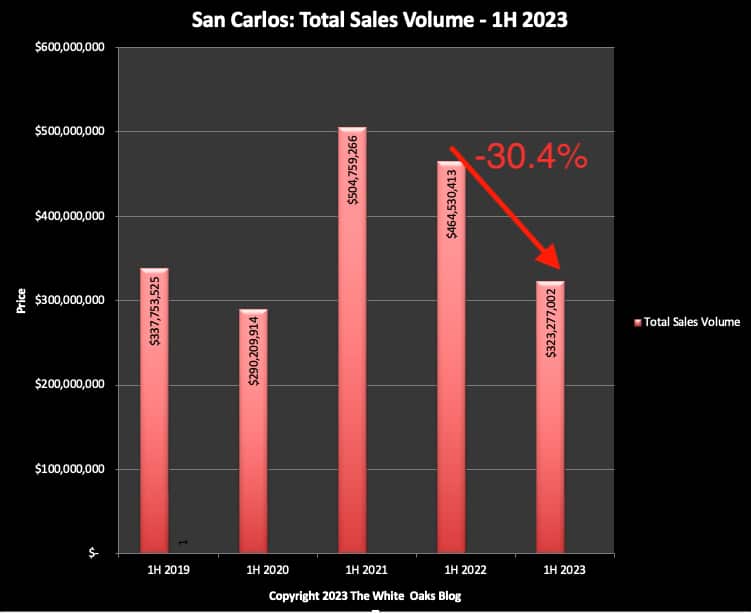

Volume Takes a Big Hit.

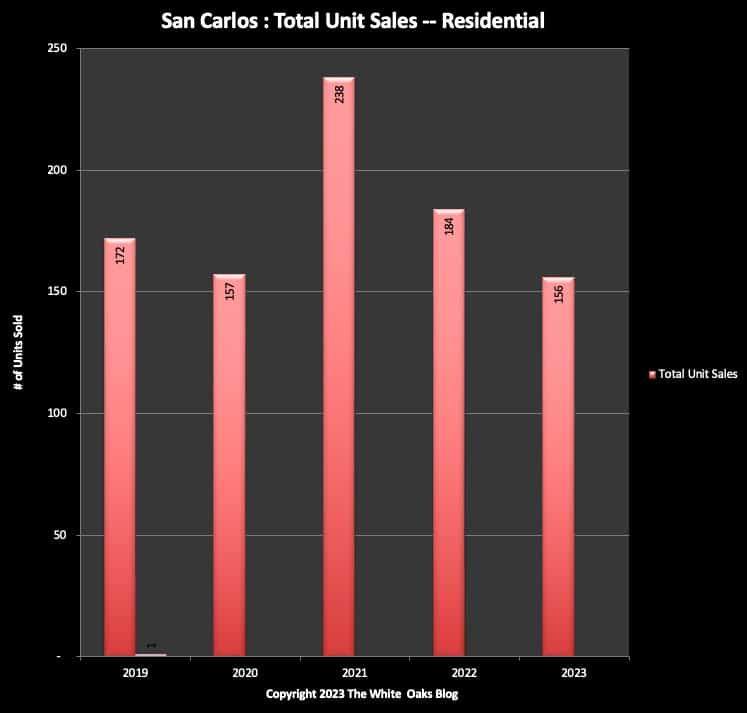

The first two graphs below compare the total dollar volume and unit volume for the first half of 2023 to previous years. Both of the graphs capture all of the single-family home, condos, and town homes that sold during that period. That's worth clarifying because they're the only graphs in this analysis that take into account condos and town homes. The remaining graphs pertain only to single-family residences.

If a picture is worth a thousand words, this one could probably fetch several thousand. Aside from the first half of 2020 when the pandemic first hit and the real estate market was completely shut down for 2 months, the total revenue tallied for the first half of 2023 was the lowest since the same period in 2017, and is down a whopping 30% from just last year.

This trend is not specific to San Carlos. You can pick just about any community on the Peninsula and you'll see similar results, if not worse in many cases.

When you start to dissect why the revenue has fallen off of a cliff, there's no more most obvious of a place to start that with the number of sales that took place:

The 156 homes, town homes and condos that sold in the first half of this year was the lowest first-half total in 13 years. You'd have to go all the way back to the depth of the Great Recession in 2010 to find a 6 month period that had fewer unit sales.

This is graphical evidence that the recent hike in interest rates and perhaps a little bit of job insecurity forced a lot of buyers entirely out of the market, and also kept a fair number of sellers from putting their homes on the market in the first place.

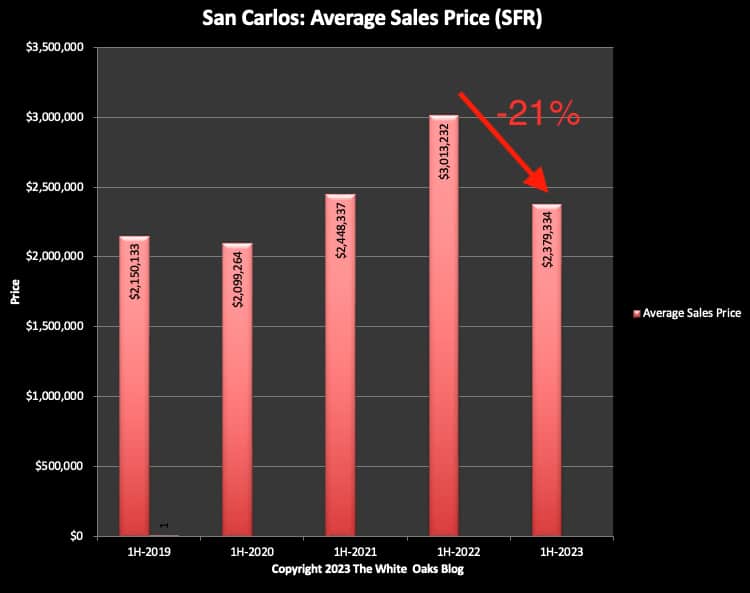

Home Prices Holding On.

Even though the stats above are critical and tell an important story, the one metric that home owners and prospective home buyers study the most is the average selling price. The graph below shows the average sales price for single-family homes in San Carlos (no condos or town homes in this one):

This is where things are not all gloom and doom. Granted, the average price of a San Carlos home dropped precipitously from just last year, but it's important to note that the first half of 2022 was the all-time high water mark for home prices in San Carlos, and this was just before the interest rates started their aggressive upward climb.

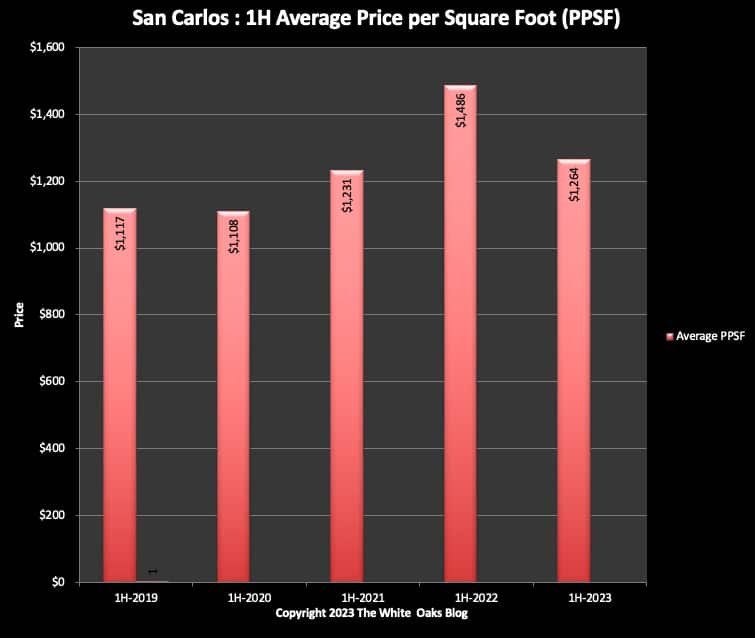

While the average price lagged behind 2022, it was still just about on par with 2021's average sales price. The average price-per-square-foot (PPSF) graph mirrors this trend very closely:

This is critical because it shows that San Carlos homes are holding their values quite well despite all of the challenges the market is facing right now. And that should give homeowners some peace of mind.

What Lies Ahead?

The second half of 2023 should be every bit as eventful and interesting as the first half. The Federal Reserve has already stated there will be one or two more minor rate hikes coming, so that will continue to put pressure on home mortgage rates. There's also continued grumbling about the economy falling into a minor recession in the second half of the year, but the same experts predicted that for the first half, and the economy managed to prove them wrong.

Despite the headwinds that continue to challenge this real estate market, I'm optimistic about the second half for several reasons. First, I've already seen a dramatic uptick in sales activity in just the past couple of months. Multiple offers are back, and homes are starting to sell quickly again, and for significant premiums above the asking price. We just weren't seeing that a few months ago.

Second, the sticker shock of 6-7% interest rates is over and home buyers have adapted to this as the “new norm.” I think everyone concurs that the days of 3% mortgages is likely a thing of the past, and while rates will likely come down again eventually, inflation is going to keep that rate at 4% or higher going forward.

Finally, all of the data that we've seen clearly shows that Q4 of 2022 was the bottom of the market and the correction appears to be over. Our local real estate market is already recovering, albeit very slowly. Short of another economic disaster, the graphs above should be trending slightly higher when I run them again at the end of the year.

Questions, Comments?

I'd love to hear your comments about this topic, and what you're hearing and seeing in the market. Feel free to leave a comment below!

Posted in: