Why Are There Fewer Homes Being Sold in San Carlos?

October 17, 2025

An Ongoing Decline.

If you read this blog with any regularity, or even just keep a casual eye on the real estate market, then what I am about to say should come as no surprise: We are experiencing a significant downward trend in the number of homes being sold in San Carlos.

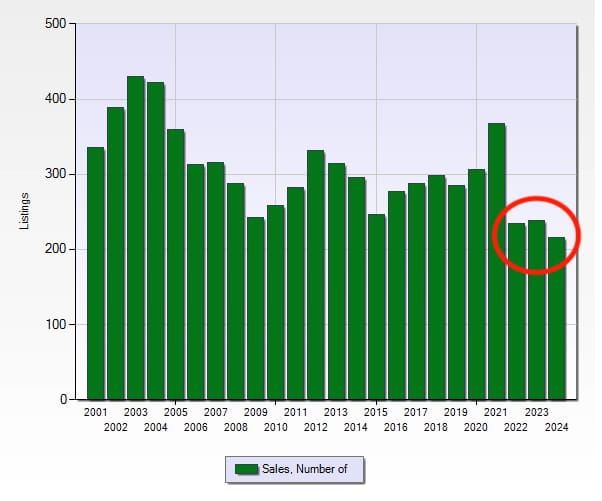

The chart below shows the number of single-family homes that have sold every year in San Carlos since 2001, and it clearly shows that, despite a couple of spikes, the number of homes sold every year in San Carlos is on the decline.

As I have mentioned numerous times on this site, the number of single-family homes that were sold across the country in 2024 was the lowest level in nearly 30 years, according to the National Association of Realtors (NAR). The 216 homes that sold in San Carlos last year mirrored the national data and were the lowest level in at least 25 years. The MLS data only goes back to 2001, so I suspect it was a lot longer than 30 years ago when the numbers were this low in San Carlos.

So why are there so few homes sold in San Carlos? It's not as if it has suddenly become an undesirable place to live — far from it. Over the past few decades, San Carlos has emerged from a quiet bedroom community that was one of the best-kept secrets on the Peninsula to one of the most desired locations for many home buyers. In fact, during this recent trough in sales, most homes that sold were still attracting multiple offers.

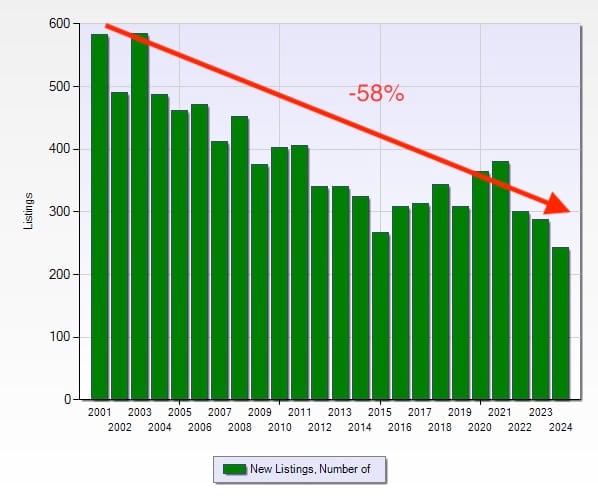

No, the reason for the decline in home sales in San Carlos can be explained in this one simple graph:

This chart shows the number of new single-family home listings (not sales) in San Carlos each year since 2001. Except for a brief blip immediately after COVID, when interest rates were at all-time lows, the trend has been steadily downward since the early 2000s, resulting in a 58% decline from the peak in 2003.

So, the reason for the decline in sales is simple: You can't buy what's not for sale.

Now that we know the answer for the drop in sales in San Carlos, the question we should be asking is: Why are fewer homes being listed for sale?

There are a variety of reasons and influences for why this is happening, and I will list what I believe are the top five below, in descending order.

Reason #5: Real Estate is a Great Investment.

When my parents moved us to Emerald Hills in 1965, they paid about $25K for their home. Back then, they never considered a home purchase as an investment – it was just considered shelter. Nobody could have predicted what would happen to the Bay Area and the home prices over the next half-century, but it made buying and holding real estate one of the best investments you could have over that period.

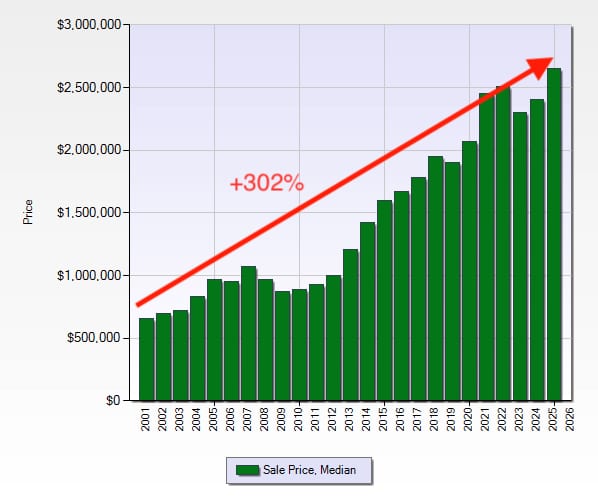

Just take a look at home prices in San Carlos since 2001:

This chart looks like a reverse of the listings chart just above. But it's hard to find a better return on investment than the 302% that the local real estate market delivered. That's why an increasing number of residents who do move into a new home (whether upsizing here, or leaving the area) are simply not selling the exit property, but rather keeping it for rental income or to accommodate their kids or other family members. The recent explosion of wealth in the tech sector is certainly making that option more viable for many people.

Oh, by the way, that same house that my parents purchased for $25,000 last sold for $2,000,000 (long after they moved out).

You get the idea.

Reason #4. Home Mortgage Interest Rates.

It would be logical to blame the recent lackluster sales numbers on the fact that mortgage interest rates nearly tripled since 2022, and I agree that this certainly played a factor in the most recent drop. Homeowners who were wise enough to purchase a home or refinance between 2020 and 2022 locked in some of the lowest interest rates in history, so it would be natural for there to be reluctance to move to a different home with a much higher interest rate. But this is not the #1 reason for the decline in listings, in my opinion, because:

- Time Period. The entire discussion about being locked into a low mortgage is only relevant over the past five years. It doesn't explain the previous 20 years of decline when rates were normal.

- Buying Down. Many sellers during this period moved to much lower-cost areas in the state or across the country. In numerous cases, they had enough equity in their San Carlos property that they could eliminate a mortgage altogether by paying cash for their new place. Worst case, they have a much smaller mortgage at a significantly higher rate. For those people, interest rates were not an impediment to moving.

- No Mortgage at All. According to this article in the San Jose Mercury News, 34% of homeowners in California no longer have a mortgage. I don't know the exact rate for San Carlos, but I wouldn't be at all surprised if it were a similar rate, if not higher.

Reason #3: Property Taxes.

I sarcastically refer to property taxes as “the gift that keeps on taking”. That's because they are due every year, and with very few exceptions, they increase every year. Proposition 13 in California limits the annual increase in property assessment to just 2%, unless you've significantly improved your home. That means that your property taxes increase at a far slower rate than the 302% increase in the median price that we saw above.

This becomes even more of an deterrent the longer someone has owned a property. It's common to find long-term residents in San Carlos who are still paying well under $10,000 per year in property taxes because of the limits imposed by Prop 13. If these owners were to theortically purchase that very same house today, they would easily be paying three to four times their current amount — every year. That's a big pill to swallow.

Proposition 19 does allow certain homeowners to take their tax basis with them if they move within the state, but it's limited to owners who are 55 years of age or older, and the new property must be of the same or lesser value than the exit property. Otherwise, the difference is assessed at the current market value. This certainly makes it a bit less financially painful to move, but not everyone is eligible to take advantage of it.

Reason #2: More Up-Sizers are Staying Put.

Many homeowners in San Carlos, especially those with growing families, find that they have outgrown their current home. This is especially true in the flats of San Carlos, where many of the circa-1940s homes aren't much bigger than 1,200 square feet. These overcrowded owners are faced with one of two choices: 1) Move to a larger home, or 2) Stay put and remodel their current home.

There are pros and cons to both of these options, and it's something that I will dive into in more detail in a future post, but there are some key considerations that make moving to a larger home prohibitive for many owners, several of which are “reasons” that I am elaborating on in this post:

- Losing the Golden Mortgage. Anyone who was even half-awake two years ago refinanced their mortgage to the post-pandemic rates that were at or below 3%. Selling now to purchase a larger home is a double-whammy — a larger mortgage with a much higher interest rate.

- Property Tax Increase. Buying a larger home usually means a much higher property tax bill, since the new home is automatically taxed by the County at 1% of the purchase price. As we discussed in Reason #3, that can be a huge increase for someone who has owned their property for a long time.

- Capital Gains. If the up-sizer was lucky enough to enjoy a huge uptick in their home value since they purchased it, which happens quite easily in San Carlos, they may end up getting hit with capital gains taxes, which is my #1 Reason below.

A good argument can be made for this to be the #1 reason why there have been fewer listings in San Carlos, since it actually incorporates several of the other reasons that are outlined in this post. But I believe that the number of people who want/need to upsize does not represent a majority of potential home sellers. However, for every house that you see being remodeled around San Carlos, you have to think that it could have been another new listing.

Reason #1 below hits just about every homeowner in San Carlos.

Reason #1: Capital Gains Tax

This choice as #1 may surprise some people because nobody seems to talk about capital gains tax that much, and yet it can easily become the highest cost of selling your home — yes, even far higher than the sales commissions. I'm also convinced that many homeowners either don't have a full grasp of this tax liability, or they mistakenly believe that it can easily be deferred to their next home purchase (it can't). For the sake of this discussion, I'm referring only to principal residences, not investment properties.

The state and federal government will indeed tax you on the profit that you earn from the sale of your principal residence. At the risk of oversimplification, that profit is calculated as follows:

Profit = Sales Price – Purchase Price + Cost of Improvements

To ease the bite of this tax, in 1997, the government passed a bill that allows a tax exemption for part of the profit from the sale. For a single homeowner, the first $250,000 of profit is tax-free; for a married couple, that exemption is $500,000. Everything beyond that is subject to capital gains tax, which, depending on your income, can be well above 20%.

You only need to look again at the chart above that shows the appreciation in home prices over just the past 24 years to see how this tax can quickly become a HUGE number. Now, just imagine how much worse it is for someone who has owned their home for 30, 40, or even 50 years. Some of those homes were purchased for less than $50,000 and are now likely worth more than $2,000,000 – even if very few improvements were made!!

Consequently, this tax liability can easily hit six figures, and in some Peninsula communities, I've heard from homeowners who are facing a 7-figure capital gains tax bill.

There are many homeowners, for either financial or philosophical reasons, who cannot bring themselves to cut that big of a check to the government, so they ultimately decide to stay put rather than move.

While the $250K/$500k exemption appears to be generous on the surface, it has not been adjusted for inflation since it went into law in 1997. There is a bill that was introduced to Congress that would essentially double those exemptions to $500,000 for a single homeowner, and $1,000,000 for a married couple, but that bill is moving nowhere in a big hurry.

I think that this significant relief in the capital gains tax would spark a larger increase in the number of new listings in San Carlos than any of the other reasons I outlined above.

(Disclaimer: I am not a tax or financial expert. You should consult your accountant or tax professional if you need more information regarding this topic.)

What Are Your Thoughts?

Do you agree with this ranking? What other reasons do you think are keeping homeowners from putting their homes up for sale? Let us know in the comments below!

Posted in: