Online Home Estimates: Why We Love Them and Hate Them.

January 23, 2026

The internet has completely changed how real estate listings are aggregated and disseminated to the public. It wasn't too long ago that listings were kept in an actual physical book at each real estate office, and agents had to pore through the book to find listings for their clients. To make matters worse, the book was only updated once per week, so it was the polar opposite of real-time data. And forget about the public seeing any of this information.

The advent of data feeds and third-party portals completely changed that. Now, anyone can get an alert on their phone the minute a property hits the market via any number of third-party apps, essentially enabling them to find out about the property at the same moment their agent does.

These apps – the most popular being Zillow, Redfin, Realtor.com, and Homes.com — all do a great job of presenting pertinent data about a property in a very concise manner. They have easily supplanted the Multiple Listing Service (MLS) as the go-to source for the general public (even though that very data comes directly from the MLS).

But let's face it… the real eye-candy that draws everyone to these apps is the home-value estimate. You know them as “Zestimates” (Zillow's brand) or a variety of other names, depending on the app. We refer to them collectively as Automated Valuation Models, or AVMs.

Automated Valuation Models

The lure of the AVM is that it provides the buyer or the seller with an instant estimate of the value of a particular home. Each of the aforementioned portals has its own mathematical secret sauce for how they come up with these valuations, and the figure that pops out is intended to be a “ballpark” estimate.

How big that ballpark actually is can vary quite widely when you compare the AVMs across different platforms. Sometimes it's a Little League field, and other times it's Levi's Stadium. I will show you an example below of just how widely varied the estimate for a particular home can be across these platforms.

Like any other computer model, AVMs can easily fall victim to the GIGO Principle — Garbage In, Garbage Out — which basically says that the quality of the output can be no better than the quality of the data that is plugged in. And that's especially pertinent to our real estate market because the data they pull for their valuation is often inaccurate. The key specifications of a home, like the square footage and the bedroom/bathroom count, are usually pulled from the public tax records, which, as I've documented numerous times on the blog, can be quite different from reality.

Even if the specifications are correct, the other flaw of the AVM model is that its ability to assess the current condition of the property is very limited. It can't tell if the home needs a new kitchen, or if the floors might need replacing, or the difference in value of a home simply based upon the presence (or absence) of a flat, usable yard. That means the “comparable” homes that they use to establish their valuation may have little in common with the target home, other than they are about the same size.

“Zillow Says My Home is Worth…”

When I put a listing on the market, I make a habit of tracking the AVM estimates from a few of the more widely used portals, both before the home is listed and while it is on the market.

Why? First, just about every seller I have ever represented knows their Zestimate or Redfin Estimate by heart, and if my estimated value of the property is significantly different than that, the very next conversation starts with “But Zillow says my home is worth $XYZ”. But that's when the true value of an experienced listing agent comes in. I have to be able to override the AVM model with “boots on the ground” data and knowledge of the market that a computer model doesn't have.

The second reason why I track these values is that every buyer who walks through the door of the open house knows these figures, too. They are using these very same apps to find the house in the first place, and I have to be able to defend my list price when presented with these “estimates”.

A Moving Target

There are two things that I find alarming about AVMs, and they occur quite frequently. First, the difference in the estimated values across the various apps can be inexplicably large. And second, the valuation within the same app can change rapidly over a short period of time for no apparent reason.

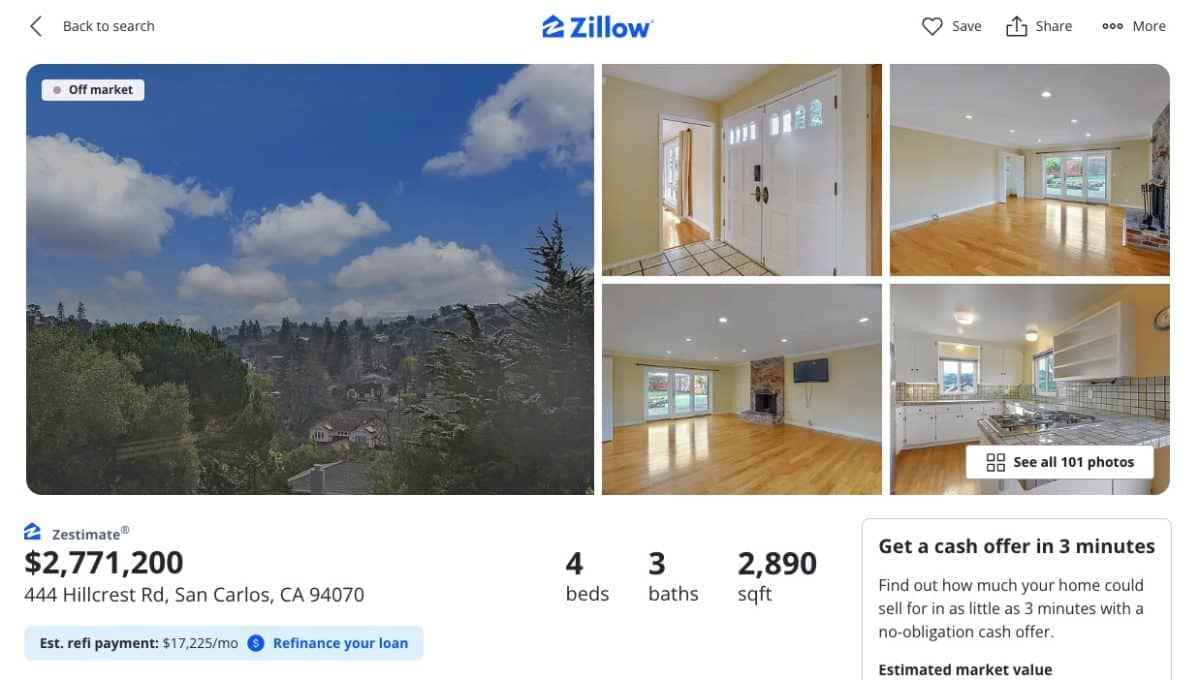

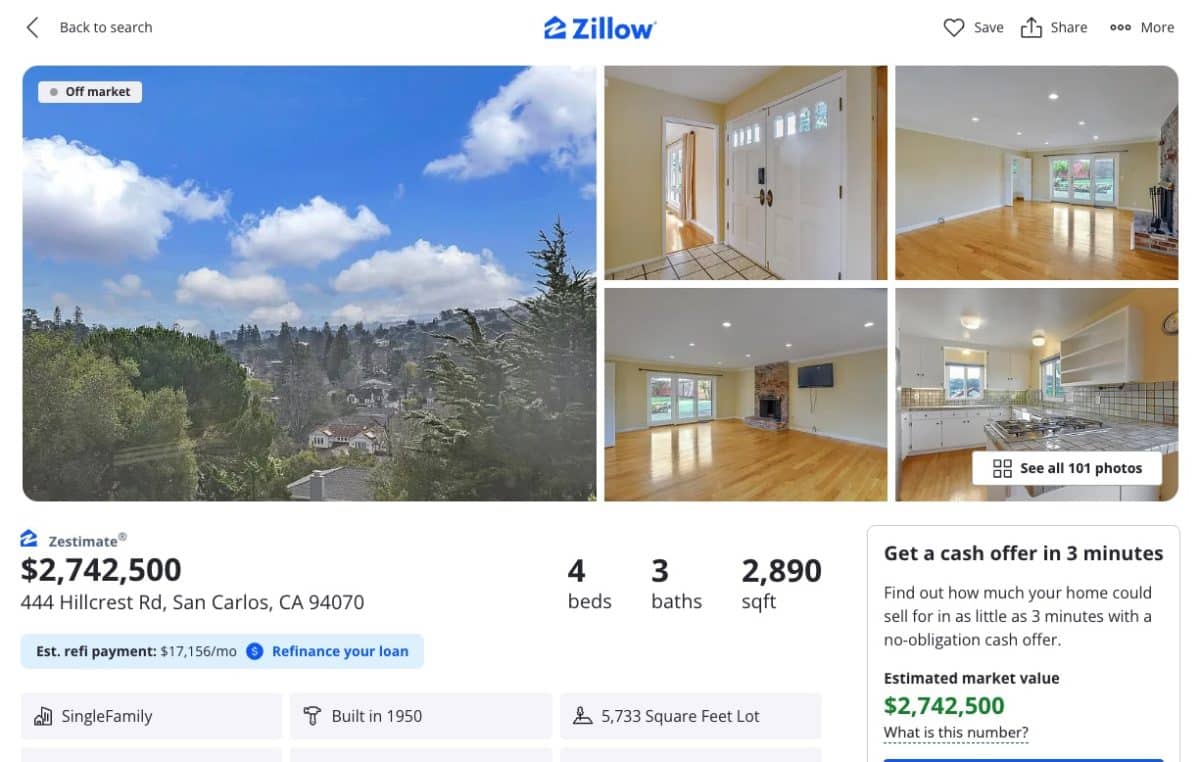

Here's a prime example to illustrate those points. I ran the AVMs on both Zillow and Redfin for one of my recent listings:

Both portals are using the exact same tax data, which is mostly accurate (there's actually an additional 1/2 bath that they are missing). Redfin's estimate of $3,089,254 was a whopping $318,054 higher, or roughly 11%, than Zillow's Zestimate – both taken on the same day.

But what I found even more surprising is that when I looked up the values the very next day, the same Redfin estimate plummeted by $203,750 — or nearly 7% — in just one day!

The Zillow estimate changed the next day as well, but only by about $29K:

What could possibly make the value of a home drop by 7% in a single day? Homes are not anywhere near as volatile as stocks, which can swing wildly in any direction simply on an earnings report or a rumor in the news. But home values simply don't inflect that quickly, regardless of what is happening in the economy.

So what does this say about the legitimacy of these home valuations?

Key Takeaways.

The point of this post is not to dismiss real estate apps. Redfin, Zillow, and the other aforementioned third-party real estate portals have poured tens of millions of dollars into creating apps that are invaluable in assisting buyers in finding and purchasing homes. They are excellent at collating a lot of very useful information into an easy-to-read format, and they give buyers the power to make educated decisions in a short timeframe, which is important in a market that moves quickly like this one.

The automated valuation models (AVMs) that these portals boldly display are useful to get a “ballpark” estimate on the value of a home, but those values can vary all over the map.

My contention is that buyers and sellers alike place far too much credence in the home estimates that are posted on these apps. No matter how advanced these computer models become, they can't accurately assess the key attributes that do impact the value of the home, such as:

- Condition: Is the home updated, original condition, so somewhere in between?

- Neighborhood: Is the home on a quiet street or a busy one? What about neighborhood noise, or traffic?

- Layout: This is one of the most critical characteristics of a home that can sway its value. Where are the bedrooms located in relation to each other, or the rest of the house?

- Yard: Does the home have a flat, usable yard or is it located on a hillside?

One of my clients who works in artificial intelligence summed it up beautifully when discussing how the public has become increasingly reliant on AI bots for their information, and the same sentiment applies to online home estimates:

The GIGO Principle has changed to “Garbage In, Gospel Out”.

Posted in: